Democrats should make good on campaign hints to upper-middle class

It seems likely that we will be hearing about the tortuous dramas of the "fiscal cliff" until the calendar closes on 2012. The president took his case to business leaders this week and will speak tomorrow to workers at a Pennsylvania toy factory, in an effort to ratchet up pressure on Republicans in Congress.

Meanwhile, House Speaker John Boehner (R-Ohio), is threatening to push the country into default unless there are drastic spending cuts. And so the wrestling match continues, teetering as close to the Jan. 1 "cliff" edge as possible.

Many Long Islanders, I suspect, will be watching how the debate settles over who is wealthy and who is middle class. President Barack Obama has drawn the line at earnings of $200,000 for an individual, and $250,000 for a household. He wants to extend tax cuts for everyone below those annual incomes.

However, this income cutoff is unfair to high-cost areas like Long Island, as some Democrats have acknowledged. In 2010, Sen. Charles Schumer (D-N.Y.) floated the idea of raising taxes only on $1-million-plus incomes. A year earlier, Rep. Steve Israel (D-Huntington) was one of eight co-sponsors of a bill, the Tax Equity Act, that would have adjusted federal income tax brackets to account for regional differences in the cost of living.

The bill was popular in the Northeast: Seven co-sponsors were from New York, and the eighth, Rep. Jim Himes, represents Fairfield County, Conn. But the bill went nowhere.

This year during election season, many more Democrats saw the light and began publicly questioning whether $250,000 was the right cutoff. House Minority Leader Nancy Pelosi, who represents pricey San Francisco, in May called for a vote to make the tax cuts permanent for anyone making less than $1 million a year. Florida Sen. Bill Nelson and North Dakota Sen.-elect Heidi Heitkamp also supported extending tax cuts for those making less than $1 million. Candidates from Missouri to Nevada to Virginia said $250,000 was perhaps too low. Some floated figures of $400,000 or $500,000 instead.

This campaign-trail flirtation with a compromise obligates Democrats to at least consider a higher-income cutoff.

There are two reasons this is important to Long Island - and, indeed, to high-cost regions around the country. First, many Long Islanders would be affected by the higher tax rate. The IRS doesn't publish data for the $250,000 income level, but about 100,000 Long Island households made more than $200,000 in 2009, according to census figures.

People making $250,000 a year don't necessarily feel wealthy. Their household could consist of a teacher and a police officer - in other words, middle class occupations. At that income, it's not always possible to fund what most Americans would agree is a middle-class life: the ability to save for retirement, afford a home and educate one's children.

More income taxes - on top of high-priced homes, local taxes, transportation, recreation and education - would make this area even less affordable. We are already bleeding retirees to North Carolina, and graduates to everywhere else.

To be sure, it may be hard to muster sympathy for a $250,000-earner when the median family income nationwide is $62,300. And bumping the cutoff from $250,000 to $1 million would lose the government $366 billion in revenue over 10 years, according to the nonpartisan Center for Budget and Policy Priorities.

But fairness dictates a second look for high-cost regions. For many people, another few thousand dollars in taxes just isn't affordable.

This essay was first published in Newsday.

Summer is education's weak link

Ah, summer. Lazy grassy afternoons, damp towels, the scent of chlorine. It's a sweet scenario, but for working parents summer is a treacherous season, filled with wrangling and expense over how to fill the 10-week break with worthwhile activities and good supervision.

Like many full-time working parents, my husband and I spend more than $7,000 a year on day camp for our two children. We employ an afternoon baby-sitter, too, who also has to be paid. Every October we start saving to meet the cost.

And we're among the lucky families. Pat Lenehan, a single father in Deer Park, told Newsday that he may have to leave his 11-year-old home alone if Suffolk County eliminates the family from its subsidized child care program. High demand and lower state funding may force the county to drop 1,200 children this month.

Yet increasingly, children are being raised in homes where all the adults work. In 2010, nearly half of households with children were headed by two working parents, and another quarter were single-parent homes.

The answer isn't more child care, it's more school. That would solve a much bigger problem than what to do with the kids during the summer: the need to improve education.

Most students lose academic skills over the summer. And we've known since 1964, when standardized tests began comparing students worldwide, that our kids rank poorly -- currently in the bottom half among 30 developed nations in problem-solving, reading, math and science.

Many school reforms have rolled through our classrooms in the past four decades, but one thing we haven't tried on a large scale is more time in class. At 180 days a year, Americans have one of the shortest school years. Germany, Japan and South Korea average 220 to 230 days.

By eighth grade, American students have spent roughly 400 fewer days in school than kids in those countries. Not coincidentally, perhaps, middle school is where Americans begin to fall behind their peers.

Low-income students tend to suffer more summer learning loss, according to sociologists from Johns Hopkins University who tracked 800 Baltimore students over 20 years. The better-off kids retained more over the summer break. Their minds were stimulated by trips to the library, to museums and concerts, and out-of-town vacations. They participated in organized sports and lessons.

But the lower-income students in the Baltimore study fell back. Researchers blamed summer breaks for two-thirds of the achievement gap seen between low-income students and their better-off peers by ninth grade -- a persistent and debilitating drag on American public schools that often translates into Hispanic and black students doing worse than whites and Asians.

Some cities have organized summer learning programs for low-income kids. Summerbridge in Pittsburgh is high-energy and hands-on -- which must be a nice contrast with the regular classroom. In Indianapolis, 11 charities pooled $3 million to create a summer program that builds on the city's patchwork of day camps, community centers, sports camps and summer jobs programs. It is staffed by volunteers from fire departments and 100 Black Men of Indianapolis, a group that mentors young people.

Long Island could make similar use of our recreational abundance. Better yet, we could do it in cooperation with school districts. That sort of innovation would require thinking collectively instead of every parent for himself or herself.

For some kids, summer breaks can be lonely, boring and even dangerous. We should put our imaginations to work to find better solutions for those lazy, grassy afternoons.

This essay was first published in Newsday.

Readers respond: Students need layoff facts

Regarding the column by Anne Michaud, "Keep school budget talk out of the classroom" [Opinion, Dec. 8], I agree that children need to feel secure in school. Their focus needs to be on learning. A major part of that learning should, in my opinion, be relating knowledge to reality. What good are the three Rs if we don't see the issues that are facing us daily?

We live in a society that has a small percentage of people voting in general and school elections. This lack of response leads to lack of control over the direction our country takes and sometimes even to corruption in government.

It is imperative that our children learn to be good citizens and participate in our democracy. If this means bringing up budget concerns to students old enough to understand, then they should be mentioned. An open discussion talking about the whole process and not focusing just on layoffs, would be in order. This hopefully would bring students to begin thinking about mundane issues that our society faces on a daily basis. Opening their young minds would undoubtedly lead to a more involved electorate later on.

Steve Tuck, Huntington

If a teacher is asked a question by a student, shouldn't it be answered? I find it amusing that a person who contributes to Newsday's Opinion pages wants to now control the things we say in class. Newspaper columnists get their forum without any input from readers.

I find all the harsh rhetoric printed in the last several years about teachers "divisive, angry and unhealthy" as well. When class sizes are larger and programs are cut, remember the true culprits: the financial institutions and oil companies whose employees and owners still get record bonuses each year -- on average, more than teachers make in a year.

Rich Weeks, Middle Island

I believe that Anne Michaud completely missed the point. School budget talks allow Social Studies teachers to discuss relevant and current issues facing our communities. This issue lends itself to great discussions of limited resources, the role of the citizen in a democracy, economic choices and a whole host of other topics. This is what we call a teachable moment.

We do our students a great disservice when we try to shelter them from what is happening in the news.

Kathleen Stanley, Massapequa Park Editor's note: The writer is a high school Social Studies teacher.

As a teacher in a public high school, I feel that I need to explain why teachers sometimes discuss rules governing teacher layoffs (last in, first out) with their students. A lot of students don't understand the difference between being laid off and being fired. They just assume that when someone is excessed because of budgetary reasons, that person has been fired for cause.

I feel it is important to explain to students how tenure and seniority work. It's bad enough when colleagues are let go. I'm certainly not going to let their reputations be tarnished with misinformation.

The column is right in this sense, that younger children should not be frightened by teachers into thinking Mom and Dad hold the key to a teacher's survival, and children should therefore convince their parents to vote for the budget. It's a cheap ploy.

However, I also think that when students come to school and tell me their parents say I make too much money and have it really easy, that I should be allowed to defend my profession. I don't think it's inappropriate to discuss the realities with older students, some of whom will be able to participate in the upcoming budget votes.

Jeffrey A. Stotsky, Forest Hills

Keep school budget talk out of the classroom

Recently, I was driving my seventh-grader to one of her many events, when she began explaining LIFO to me. She told me that the youngest teachers were usually the ones to lose their jobs when there are budget cuts: "last in, first out."

I don't consider this information a seventh-grader should be thinking about - except perhaps when learning labor history in the classroom. She said that her teachers, and others, have been talking about the politics of school budgets.

It may seem a little soon, given that budgets won't be up for a public vote until May. But people are thinking ahead since this time around will be different. New York schools will be budgeting to stay under the 2 percent property tax cap passed earlier this year.

This week, Gov. Andrew M. Cuomo negotiated a deal to restructure state income tax rates so that New York will be able to afford a promised 4 percent increase in state aid to schools next year. I hope that deal takes some of the tension out of the classroom, because I don't think school budget cuts are a proper topic for students.

I first heard such concerns from my daughter when she was in fourth grade and came home to report that her teacher might lose her job if the school budget didn't pass. The message to parents was that we should get out and vote "yes." It was the emotional equivalent of dangling a baby over a banister.

I sent an email to another teacher, who was the supervisor of my daughter's program, and said I didn't think they should be talking in class about teacher layoffs. First, it's scary for kids to think that the teacher could suddenly be gone. There's an emotional attachment between student and teacher.

It's also frightening for kids to contemplate how their teacher might be harmed by job loss. Last, it's unfair to imply that Mommy and Daddy hold the only key - the ballot box - to saving Teacher's job.

Could it be that if the school board had negotiated a more modest teachers contract that it could afford to pay more teachers year after year? Of course. Could it be that if administrators found savings - like condsolidating their ranks or settling for less luxurious compensation packages - that the system could afford to lay off fewer teachers? Right again.

But I didn't say that when I emailed my daughter's school. I simply said that I felt the financial conversation was best kept among adults, and that students might be frightened by layoff talk.

When teachers raise district budget issues in class, it feels like divorcing parents who are pointing blaming fingers at each other. It's divisive, angry and unhealthy. I feel the same way about teachers refusing to stay for after-school help or wearing black to school to protest that they're working without a contract. These "conversations" should occur among adults. Kids should be able to focus on adaptive immunity and rational integers and the branches of government without being distracted by budget politics.

Teachers surely want to be treated like professionals - and I've met far, far more good teachers than the occasional inconsiderate one. But a few loose comments - such as how my daughter learned about LIFO - can poison the atmosphere.

With the tax cap in effect, the conversation about how to pay for public education is going to become tenser in coming years. We can figure it out, but let's do it in a room where only the grown-ups are allowed.

First published in Newsday.

Time for a 'living wage' for the middle class?

With millions out of work, complaints about the decline in middle-class wages may seem misplaced. But without some shoring up, the middle class will remain dispirited -- and our economy, which is 70 percent dependent on consumer spending, will remain in the dumper.

It may be that there's a role for government to play in buttressing these eroding wages, which result not only in a declining standard of living, but also in a family life so pressure-filled that it leads to its own problems: angry homes, fast-food diets, dependence on alcohol and drugs.

Calling for any sort of government role during these tea party times can raise charges of socialism. But the idea of a wage that supports some minimum standard of living -- shelter, clothing, food -- has been broached on and off for more than a century.

In the late 1800s, social activists began protesting wages earned by a working-class man that were not sufficient to sustain his family, without the additional wages of working children and mothers. The Catholic Church published a fundamental social teaching, "Rerum Novarum" (on capital and labor), that read, "Wealthy owners of the means of production and employers must never forget that both divine and human law forbid them to squeeze the poor and wretched for the sake of gain or to profit from the helplessness of others."

Shortly afterward, Australia's courts ruled that an employer must pay a wage that guaranteed a standard of living that was reasonable for "a human being in a civilized community" for a family of four to live in "frugal comfort."

In the United States, these ideas led to laws forbidding child labor, making education compulsory and protecting women from exploitive labor conditions. The campaign to establish a "family wage" was defeated, but in 1938, a lower standard, the federal minimum wage, was passed.

The Rev. Martin Luther King Jr., Daniel Patrick Moynihan and in 1968, a group of 1,200 economists including Paul Samuelson and John Kenneth Galbraith, have all supported some kind of minium income guarantee.

Echoes of this debate are being heard now, in the Vatican's critique last week of the global financial system, and in places where labor unions still have some sway: In the New York City Council, which at the urging of retail workers may require employers in commercial developments built with public subsidies to pay at least $10 an hour, a "living wage" higher than the minimum wage of $7.25; and in Albany, where the State Legislature in April passed an increase to $9 an hour for home health aides, who are represented by the influential 1199 SEIU United Health Care Workers East. That increase takes effect on Long Island in 2013.

It's easy to see why the lowest-paid workers would need a boost from someone powerful enough to argue on their behalf. But to make the argument for the middle class, one has to believe that this great swath of America, nearly half the country, has special value. And it does: The stability and upward mobility of the middle class not only underpin the U.S. economy but give America its famously optimistic and innovative spirit.

That spirit is on display as the middle class makes the best of things today: The average American has added around a month's worth of work, 164 hours per year, in the last two decades. One-third of American families have reduced their savings for college, according to a 2010 Sallie Mae/Gallup poll, and another 15 percent are not saving at all. Retirement savings are in similar decline.

How much more can the middle class cinch in its belt, before we lose what's precious about this way of life?

Down times, empty suburban storefronts

Atop sports bleachers and inside minivans across Long Island, gloom about the economy is never very far from mind. The current generation of middle-class householders is used to the normal ups and downs of the economic cycle, but none of us is prepared for a second "down" right now -- the terrifying, rumored double dip.

Recently, as I rode with some other parents along Route 110 from Huntington through the busy Melville corridor to Farmingdale, the conversation turned to how many empty buildings we were passing. One man recalled visiting a now-vacant office center to close on the purchase of his house. A favorite wedding reception hall had been demolished. The Checkers drive-through was suddenly out of business -- open one day, and stripped of its signs the next. Even the dollar store -- maddeningly misnamed "Things Over $1" -- has closed.

How does a dollar store fail during a recession, when everyone's looking for a bargain? The unspoken fear is that perhaps this time, it's something worse.

The Week magazine recently concluded that we aren't in an ordinary economic cycle, but that Americans are in the process of paying off mountains of debt. We had grown used to living on credit, and we are now regretting having covered ourselves with piles of bills just as the economy was about to stumble. For an economy that was 70 percent propelled by consumer spending, tight home budgets are incapacitating.

Others say that the emerging economy -- outsourced and technology-dependent -- is unfavorable to the middle class. It can only benefit those at the top. While economists pull apart the numbers to make sense of it all, the middle class is endeavoring to persevere.

Many are forming new philosophies about kids and college, for example. Two years at a community college add up to a potentially employable graduate with an associate's degree. Meanwhile those same two years at a four-year institution equal, perhaps, nothing more than a college dropout with loans to repay.

One acquaintance told his high school senior that if she wanted to go to a private university, she would have to pay the difference between that tuition and SUNY's. There is praise for the child who chooses the practical -- accounting or engineering -- and a roll of the eye for liberal arts majors.

Nobody says directly that money is tight, but that thought is always lurking. Without asking if we needed it, my daughter's orthodontist offered us a financing plan. While we were school shopping, the clerk at Macy's warned that the jeans we were considering cost a whopping $89.

These small kindnesses are a balm in difficult times -- especially because the opposite coarseness so often confronts us, too. School clubs demanding payment for expensive class trips. The classmate whose outfits display Abercrombie & Fitch logos. The burgher purchasing a case of good red wine, and tipping the clerk to carry it to his Cadillac Escalade SUV.

There used to be far more class trips, designer clothes and Escalades. Or, so it seemed. The new polite is to talk cheap. Where to find the best thrift stores, and bargains at the gas pump. Good buys in used cars. Off-price movie tickets.

Because even if we aren't having financial troubles, we know many who are. The new adult horror story is the acquaintance who hopped the Long Island Rail Road to attend nine job interviews with a potential employer -- only to have the company eliminate the opening in light of more bad economic news. A divorce lawyer remarked that he used to divide up assets; now he parcels out marital debt.

Long Islanders can be resilient. But we'd like to know, how much longer?

Economic trends threaten families' health

After listening to President Barack Obama's job-creation address last week, I kept coming back to the idea that he wants to give payroll tax breaks to businesses that offer people pay raises. That struck me as odd, given that unemployment stands at 9.1 percent, and you'd think that this hard-times president would be focused exclusively on getting people back to work.

But even people with jobs are facing time and money pressures in this economy, pressures that are bad for families' health.

Certainly, putting cash in people's pockets should help to rev up the listless consumer economy. But it looks like the president is also acknowledging just how much wages have eroded in the last couple of decades.

Real wages have been declining since 1983 and that means the middle class has less buying power. At the same time, the average American has added around a month's worth of work -- 164 hours per year -- in the past two decades. The number of dual-income households has risen, as well as the number of people working multiple jobs. It's not hard to imagine that people are putting in more time at work to make up for the erosion in their wages. That sounds like a very busy -- an overly busy -- middle class.

This busyness has consequences for the mental and physical health of parents and children -- and study after study substantiates this. A six-year study of 11,540 working parents in France, published in 2007, showed that people who had higher work stress or greater family demands were more likely to miss work due to poor mental health, particularly depression. Research on working parents in New York's Erie County demonstrated a relationship between family-work conflict and depression, heavy alcohol consumption, poor physical health and high blood pressure.

Time pressures also contribute to weight problems. For the first time in history, there are more overweight than underweight adults worldwide, according to new research at American University. A study published in the January-February issue of the journal Child Development found that children's body mass index rose the more years their mothers worked over their lifetimes. One explanation offered is that working parents have limited time for grocery shopping and food preparation.

Not so long ago, as a society we were asking, is it better for families if parents stay home with kids or work outside the home? Moms were usually the parents in question. Now, because of steadily declining purchasing power, for most people, it's less a matter of choice than necessity.

I have to ask myself, was this a conscious decision? Did Americans choose "working parents" as the better alternative? Was it a good direction or have we lost something in the translation? Have we perhaps given too little thought to how parents can give both their employers and their children what they need?

The financial and time pressures on families are what make us so vulnerable to implied criticisms, like those on display in Amy Chua's "Battle Hymn of the Tiger Mother." It registered so strongly with American parents because we're insecure about having adequate resources to meet the challenges of raising children now.

It's too early to tell if the Obama tax break, if adopted, will be effective in raising people's wages, or even whether, if we made more money, we would choose to spend more time with our children. But it's worth trying to reverse some of the trends that are putting so much pressure on families' health.

Hurricane Irene: Life in the dark ages

One lesson from Hurricane Irene -- or make that, Irene, the tropical storm -- is that we have no moderation in our information flow. It's either all . . . or next to nothing.

For days, weather-watchers reported the direction and shifting wind speeds of the approaching hurricane. We couldn't look at a television, website, smartphone or tablet without a reminder to stock up on drinking water and fresh batteries. This constant nagging heightened the feelings of urgency -- especially for those of us who grew up in a relatively media-free age, when headlines waited patiently on the doorstep until we were ready to take them in.

The blanket storm coverage may have kicked up our anxiety a notch too high, especially since the hurricane slowed significantly before it hit New York. All those masking-taped shop windows afterward seemed overcautious.

But the frequent alerts also made many of us better prepared. My household had never so much as inventoried our flashlights. This time, our outdoor furniture was lashed tightly together with bungee cords, and we had a full propane tank for outdoor cooking -- which proved handy since we were among the hundreds of thousands of tristate homes that lost power.

The pre-warnings about Irene had another effect: They made the morning after seem unbearably quiet. Without electricity, there was no Internet telephone service, no website browsing ability. My family hadn't gotten to the store in time to buy batteries for the radio -- those Ds sold out quickly -- so we started up the truck in the driveway, eager for news. Had the storm passed? Were we in the calm eye and vulnerable to another blast?

It's impossible to imagine my parents' generation being caught without radio batteries.

By midday Sunday, people were emerging from their homes to look around at the wreckage. It was reassuring to be amongst each other. Snapped pine branches scented the air like Christmas.

Some shops were open, powered by noisy generators. Two of the Greek restaurants in Huntington Village had open doors, not to be outdone one by the other. Several caffeine addicts lounged mournfully on the steps of the darkened Starbucks. Neighbors sat on porches with books, turning actual pages and reading by daylight.

A second lesson of Irene is how dependent we are on electronics not only to inform, but also to entertain.

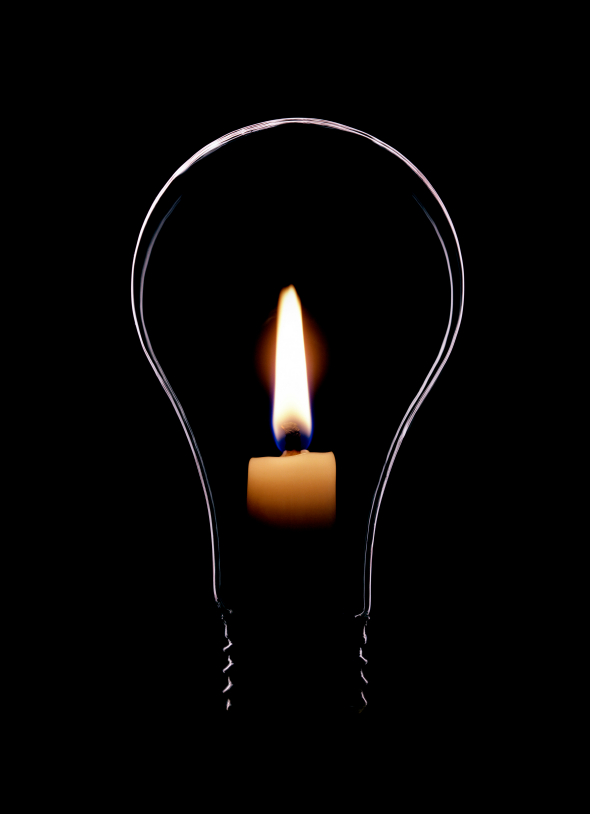

Back at home, still chipper about our power loss, my daughter set up a game of Clue. Afterward, we read until the light faded. I had a charming Jane Eyre moment, transported into the 19th century in my imagination as I carried a candle to the basement to feed the cats. Did Jane also scoop kitty litter by candlelight?

Our peaceful acceptance didn't last. My daughters quarreled over how to use the remaining charge in the laptop. Power up one iPod Touch? Play an audiobook they could both listen to?

As darkness closed in, the quiet was broken by a high-pitched whine. It stopped, then started again, several times. Annoyed, I asked my husband what he thought it was. He replied, "Crickets."

So, that's what's on the other side of the air-conditioners' hum.

Darkness fell before 8 p.m., but who goes to bed that early? We burned greedily through our last energy resources, playing solitaire on the iPad.

Monday morning, still without power, my husband shouldered his laptop and went in search of public places with Wi-Fi. I trust the Long Island Power Authority is hard at work.

First published in Newsday

Mortgage schemers' luck runs out

Mortgage fraud arrests have begun showing up with great regularity on Long Island. Fourteen people were charged last week with stealing $58 million in a fraud ring that involved more than 100 homes. Another 14, in a separate case brought by the Nassau County district attorney, are facing trial in October.

And there are reports of arranged sales on the rise -- cases where a homeowner falsifies a sale, effectively forcing the bank to reduce the mortgage on a home. That may sound like justice for a home that's lost value, but it's illegal, and it unfairly spreads the loss to the bank's other customers.

Why all this fraud in the news? Well, it turns out that Long Island is a hotbed for such schemes. The U.S. Treasury Department's Financial Crimes Enforcement Network says that Nassau had the fifth-highest number of suspicious reports of mortgage fraud per capita, among counties nationwide, in the third quarter of last year.

It's fascinating how people can think of different ways to make a quick, illegal buck. The convenience store robbery just doesn't compare for intrigue -- where's the imagination?

White-collar crime often involves people who had legitimate skills but at some point recognized an opportunity to cash in. In the case brought by Nassau DA Kathleen Rice in March, accused ringleaders James R. Sweet and Dwayne Benjamin were paying acquaintances $10,000 to pose as home buyers, and telling them that they were going to fix up the home and "flip" it. They portrayed it as an investment partnership.

So, the phony buyer took out a mortgage some $30,000 to $40,000 over the sale price, Rice said. The ringleaders allegedly paid off the "buyer" and pocketed the difference. There was no longer a homeowner to make payments on the house, leaving the bank to foreclose.

You can see that when home prices are rising, banks wouldn't be as unnerved by this scheme. But their sense of injury is high today. "For it to be fraud, somebody has to be damaged in some way," says Abigail Margulies, chief of the Crimes Against Real Estate unit in Rice's office, which was formed in late 2008.

Sweet and Benjamin allegedly became more brazen, eventually having people impersonate both the buyer and the seller, and swindling the bank out of the entire loan amount -- six times in one six-month period.

That's a lot of greed. More sympathetic, but just as illegal, are the homeowners whose mortgages are higher than the value of the home -- so-called underwater loans. They intentionally default on the loan and convince the lender to take less than is owed in a "short sale." In reality, the homeowner has arranged beforehand to "sell" the home to a friend for a lower price, and then continue to live in it.

The homeowner is sticking it to the bank that wouldn't renegotiate the loan. You can see how someone could justify that in their mind: "Why am I paying $4,000 a month to live in this home, when if I sold it, the new buyer could pay $1,300?"

A sense of injury runs high, and people feel they no longer need to play by the rules. Some people just walk away from underwater homes.

We'll be reading about more cases soon, says Margulies. Fraud takes a while to recognize and document. The charges being brought now are for crimes that occurred four or five years ago -- back before the 2008 crash, when there were loosey-goosey mortgage application rules about documenting employment or income.

Apparently, making loans to people who couldn't afford them was only part of the problem that led to the crash. Those loose practices also schooled would-be defrauders in how to game the system.

First published in Newsday

Health bill threatens to bankrupt man

A year ago, Tom Carlo's back was killing him. And now it's simply threatening to send him into bankruptcy.

Carlo, 63, has struggled for more than 40 years with back pain, since falling out of the second floor of an Air Force barracks in 1968, when his unit was under attack in Vietnam. Last spring, he was unable to sit for very long because of the pain, and he was taking drugs that were wrecking his stomach. He opted for a spinal surgery -- his third -- recommended by a doctor.

The surgery was supposed to lead to a cure from pain, and Carlo has found some relief. But his financial problems were just beginning. In June, his insurance carrier, CareAllies, OK'd the operation. In July, Carlo checked into Winthrop-University Hospital in Mineola. In August, CareAllies reversed its decision and denied payment to the two surgeons who operated.

"When the insurance company gives you the OK, you figure, let's do it," Carlo said. "Two months later they told me I should have tried physical therapy or shots -- well, it's too late now."

This is an unpredictable moment in the business of medicine, with costs soaring, the federal government rewriting rules, and insurance companies and doctors vying for some control over the inevitable changes. But people like Tom Carlo, a retired U.S. Postal Service letter carrier who drives a school bus in Garden City, shouldn't have to bear the brunt of these tectonic shifts. He appears to be caught by an insurance carrier balking at astronomical fees from an out-of-network doctor.

New York, unlike other states such as New Jersey, doesn't have a law against excessive billing.

CareAllies, a unit of Cigna, provides health services under contract to the National Association of Letter Carriers. Carlo's plan is a PPO -- a preferred provider organization -- which supposedly gives him the freedom to shop around for a surgeon, provided he shoulders a greater share of the bill. PPOs often pay 70 percent of the "usual and customary" costs of out-of-network care.

The whopper surgeons' bills may have had something to do with CareAllies' change of heart. The primary surgeon billed $355,000, and the assistant surgeon $160,750. Enough to pay for Carlo's tidy Wantagh house and then some.

He has appealed the decision up the chain to the U.S. Office of Personnel Management, which is ultimately responsible for the letter carriers' insurance contract. A representative of that office didn't return phone calls for this story. In a letter to Carlo, CareAllies said that his records had been checked as part of a random audit, and that an independent reviewer had determined the surgery was not medically necessary. Winthrop Hospital and Cigna said they will look into Carlo's case.

In Nassau County, the "usual and customary" rate for this surgery would have ranged between $49,750 and $64,750, according to Empire BlueCross BlueShield. Dr. Scott Breidbart, Empire's chief medical officer, said that out-of-network billings are an area of heated dispute between insurance companies and doctors.

Normally, the insurance company and the doctor would try to negotiate. But Carlo has been appealing CareAllies' decision for 10 months. If the Office of Personnel Management denies his claim, the next resort will be to sue in federal court -- an exhausting and expensive prospect.

Carlo's tale isn't unique. Medical expenses are a leading cause of bankruptcy. But it's an example of why we need health care reform. It doesn't get much worse than having a $515,750 bill dumped in your lap.

First published in Newsday

Home-sharing's time returns

Pushed along by those twins of the Great Recession -- unemployment and foreclosure -- America may be moving back under the multigenerational roof.

At a recent reunion of high school friends, I talked to one who had returned to her mother's house, along with her brother and sister. The whole family was back together again, this time with grandchildren added to the mix. It was a disaster. The siblings were fighting as much as they had in high school.

Another friend's son was enlisting in the Army to avoid moving back into her home after graduation. The Census Bureau says that 54 million Americans were living in multigenerational families in 2010, up from 49 million two years earlier. That's the highest count since 1968.

Of course, it's nothing new for large extended families to live under one roof. In many parts of the world, it's the norm. In this country, Asians and Hispanics have higher rates of multigenerational living, perhaps reflecting greater cultural acceptance.

But for the most part, since the 1950s, the American middle class has assumed that one is up and out at 18. Each nuclear family, according to this standard, had its own home.

And that attitude can make moving back in together -- or "doubling up" in demographers' terms -- feel like a step backward. It can be a sign of financial desperation, a response to unemployment, lack of child care or health care, or affordable rents.

But there are many advantages that generations can offer one another: care-taking for the young or old, emotional support and the sharing of life lessons. Those benefits -- as well as the financial considerations -- are what led the Huntington-based Family Service League, a social services agency, to create its HomeShare program, which matches older adults with someone who could use their spare bedroom.

Artist Milton Colón, 47, heard about the program through Fountainhead Church in East Northport. He is sharing the Smithtown home of Meinhard and Aino Joks, who are 86 and 85. Colón does the laundry, cooking, bed-making and errands, allowing the Jokses to stay in their home even though their home health care benefits have run out.

In turn, the Jokses have given him shelter and stability. Colón's wife of 22 years died in 2008, of an accidental overdose, and he fell apart. He began living out of his car.

While she was alive, Colón had made a living painting portraits. He was as busy as he wanted to be -- before the recession drained his Brentwood business of customers.

The Jokses are from Estonia and Finland and tell him stories of their emigration after World War II. "I'm a World War II history buff," Colón says. "So, that's something we share. I love history. I could take it in all day."

In the evenings, he works at a basement desk on a comic strip that he's developing. It's about a proud Puerto Rican father named Flores who moves his family from Brooklyn to the suburbs -- "Flowers in Blue," Colón's own story. His new home with the Jokses not only tethers him back to family life, it gives him an artist's freedom from financial worries.

That's the facet of multigenerational living that is not often expressed. We all know about the tensions and bickering -- the fall from the ideal after having somehow slipped off the path to the single-family home. But there is sweetness, too.

So why not make the best of what, for some, has become the new American reality? With 8.8 percent unemployment and 2.36 million homes foreclosed by banks between 2007 and 2010, the middle class is struggling. Independent living may be an American value, but so is helping each other through hard times.

First published in Newsday

Schools challenged to cut costs, preserve quality

A couple of weeks have passed since I asked people in this space to send ideas about cutting school costs, without harming the things we all cherish -- our best teachers, high academic goals, and the extracurriculars that inspire kids to find their place in the world.

I've been overwhelmed by the response. Not so much the volume -- about 45 calls, e-mails and letters -- but by the quality. People have sent thoughtful, 4- and 5-page letters with good ideas about how to cut spending without hurting students. Former and current school superintendents, school board members, teachers and their spouses, parents -- they all want to get in on the conversation.

The response made me wonder whether, as Gov. Andrew M. Cuomo tries to target his $1.5-billion cuts to school budgets statewide this coming year, it might be worth convening a panel of informed citizens to come up with recommendations.

Here's your best advice:

--Salaries make up 60 percent to 75 percent of school spending. Freeze salaries, including the automatic yearly longevity "step" raises, and stop giving increases for extra training that, while important, adds little to classroom effectiveness -- such as courses on sexual harassment or peanut allergies.

--Give school boards more spine. Require that contract negotiations take place on a townwide, regional or statewide basis. Prohibit school districts from hiring board members' families. Stop "loading up" school boards with people who work as school administrators or teachers in neighboring districts.

--Do the math. One man wrote that his district had 6,687 students and 725 teachers. Figuring about 24 students per class . . . that leaves 446 teachers who aren't in the classroom. What are they doing, exactly? Those who wrote me seem very concerned about the large numbers of adults in schools.

--Consolidate neighborhood schools. Lawrence has closed two school buildings, netting $30 million. That money was used for maintenance to other buildings ($17 million) and a reduction in property taxes.

--Make athletics and other activities pay-to-play. Parents should pay for their kids to participate, and the group could raise money for families who can't afford it.

--Increase class sizes, especially in the upper grades. Why can't high schools use lecture halls, like colleges do? Or offer online classes?

--Charge parents whose kids are earning college credits while in high school. They would be paying the college for those credits otherwise.

--Require schools to "go green," inspiring energy savings of 10 percent or more.

--Penalize teachers who are absent a lot. (Although it's not a cost savings, another idea is to reward teachers who work in difficult school districts.)

--Put high school and college students in kindergarten and first grade classes, and give them college credit to help out.

--Consolidate school districts. This was mentioned a lot, but the political reality doesn't seem to favor it.

--Do away with universal bus service.

--Get rid of tenure.

When my family moved here in 2003, the schools were a big draw. Long Island needs to treat the quality of its schools as a treasure, even as we pare them down to a more reasonable cost.

The most depressing response when I asked for ideas about cutting school costs was this: "There have been no solutions and likely never will be any." The best? "It only takes some good ideas and those with the strength of conviction to get the job done."

So, what's it going to be, Long Island?

First published in Newsday

Public schools lack independence to analyze cost-savings

Lately, everyone seems to be offering ideas about how to save money in the public schools. People familiar with business or even household budgets look at the problem and want to apply a little common sense. One of the most popular suggestions: Cut the number of superintendents down to one each for Nassau and Suffolk counties, for a potential savings of more than $25 million.

That may sound like a lot, but it would amount to just one-third of 1 percent of the $7.5 billion that Long Island's 124 school districts spend each year. Even so, it's clear that residents are ready for some sign of good-faith reductions from schools.

Decreasing the number of superintendents gained wattage last week as Gov. Andrew M. Cuomo addressed crowds around the state and talked about how much these school leaders are paid. He says that 40 percent make $200,000 or more.

Teachers' raises, "steps" (built-in longevity raises) and credits for coursework - which add up to increases of about 6 percent a year - also have Long Islanders reaching for their budget shears. So do the cadres of assistant superintendents, directors, assistant directors, principals, assistant principals - and on and on.

Per-pupil costs reach $23,000 in some Long Island districts, more than double the national average of $10,259. So, yes, Long Island's school costs appear fat. That's why it's surprising that study groups charged with finding savings always come up with so little.

Take the years-long initiative by Nassau County school districts to consolidate non-classroom operations. Albany gave the districts a $1-million grant to figure out how to save money, in part by jointly bidding contracts. The study group looked at student busing, school inspections and cell-phone use. It spent half its grant money - and came up with a mere $760,000 in potential economies. Early estimates were $5 million in savings a year. What a disappointment.

Then there's the Suffolk County study that was supposed to save money through pooled health insurance. A consultant concluded that the reduction would amount to two-tenths of 1 percent of current costs. That useless exercise was funded by a $45,000 state grant.

These studies are plainly approaching the question the wrong way. They seem to eliminate from the outset any possibility that would cause a friend or ally to forfeit cash. For example, the Nassau County group declined to consider using the county attorney's office for legal work, preferring instead to continue paying outside lawyers "experienced" in school law. As if the county attorney couldn't gain adequate experience within a short time.

People inside the school community, who are invariably leading these studies, just aren't independent enough to ask the hard questions. But outsiders are rarely invited in. Instead, those outside the school corridors are essentially told: You don't understand the requirements and pressures on schools. And outsiders are never trusted with essential information to make smart decisions. If you've ever tried to read a school budget, you know what I mean.

We need some sort of hybrid, an independent study group with insider knowledge, like the 2006 state Berger Commission on hospital closings. Budgets are tight. It would be wonderful to find the $1.5 billion in school savings that Gov. Cuomo has targeted without sacrificing music or art, accelerated programs or special education resources, late buses or athletic programs. Maybe that's impossible. Anyone with a novel approach, please drop me an e-mail. This problem needs all the brainpower Long Islanders can bring to bear.

First published in Newsday

NY needs to cut special ed spending

Two years ago this month, the Suozzi Commission came out with a startling report. Charged with finding a way to lower property taxes, the group - formally named the New York State Commission on Property Tax Relief - turned sharply off course to detail the escalating cost of special education.

For more than a year, the commission looked for fundamental reasons why New York's property taxes are so high. It asked public school officials who, one after another, pointed to special education.

So, the commission assigned a task force to examine special ed. It found that the state has 204 "mandates" beyond federal rules that make our special education system the most expensive in the country. On average, New York schools spend $9,494 per pupil in regular classrooms, and a prodigious $23,898 for each special education student.

Our state is rightly proud of its generous and progressive history on education. But you have to wonder, as a new administration takes over in Albany next month with a $9-billion deficit chained to its ankle, whether it's time to take another look at the Suozzi Commission's findings. After all, the state Council of School Superintendents called them "the most thorough independent review of New York's special education policies in the more than 30 years since the current basic structure was put into place" - yet they've essentially been ignored.

One problem with special ed is that too many students qualify. Don't assume that these programs serve only those students diagnosed with a severe mental or physical challenge. In fact, more than half the students in special ed simply need extra help in reading or math, speech therapy or other support.

Schools receive extra resources for special ed students, so they have an incentive to label marginal students as disabled. But what if not all of them are really disabled? Not only would that be a waste of money, it would harm the truly disabled students by overburdening the resources meant to serve them.

Also, shifting non-disabled students into special education can stigmatize them and sidesteps problems, like failing schools, that should be addressed head-on.

Once kids are in special ed, schools must meet minimum requirements for them, like drafting an individualized education program every year. Students in speech therapy had to attend at least two sessions a week - no matter what their needs were - until the Board of Regents relaxed that rule last month.

Such regulations may sound trifling, until you consider there are 204 of them, on top of a tome of federal rules.

School officials are also required to hold legal hearings, at an average cost of $75,000, if a parent questions a student's placement. (Parents pay some of the cost.) In the 2007-08 school year, 6,157 hearings were requested. A case for one child on Long Island cost $300,000.

Parents can sue to have the school district pay for private school tuition - as much as $25,000 a year or more - and for bus service within 50 miles of a child's home. In theory, a Mineola student could qualify for door-to-door service to a school in Greenwich, Conn. - although it defies logic that a parent would want that.

Last month, New York's Regents did away with a few of the 204 mandates, but nothing that will cut costs. What's needed is a study of results: which strategies work best to move students on to college or the workforce. Schools should know what leads to success.

Parent advocates for students with disabilities correctly argue that early intervention - say, remedial reading in lower grades - prevents problems later on. And no one wants a child to struggle needlessly. But the spending gap is outrageous. It's time to find a middle ground.

Originally published in Newsday

Crossing the pre-teen ravine

A couple of nights ago, my two daughters and I set up yoga mats in the living room. I had discovered that I could stream yoga instruction videos through Netflix's "instant play" option. So, we set the laptop on the coffee table, selected a video and stretched our way through downward dog and camel. I'm searching for new ways for us to enjoy time together, now that they are leaving childhood. I'm actually in a small panic about the whole thing, although I tell myself that it will pass. Dan-my-husband went through this several months ago, as Isabelle rounded her 12th-and-a-half year and bulleted toward 13. "She was such a great kid," he mused one evening, changing into his pajamas.

"She's still a great kid!" I replied, defensively. But I knew what he meant. Her interest in being a child had been full and complete. She barreled down snowy hills, caring to catch every mogul. She worked her diving board technique with a religious passion. She never met a dog she didn't go out of her way to greet. Rocks from her collected adventures littered my kitchen windowsills.

Isabelle's maturity was the first shock, but Charlotte, 17.5 months younger, is following fast behind. They are dragging up the rope ladder behind them. Suddenly, I find myself with -- O, joy! -- time to pursue the interests I have been suppressing these long years, more than a decade. I emerged recently from a three-month jag of writing a book proposal, having satisfied a long-deferred longing in my heart, only to find that my daughters no longer needing me so intensely. I felt as though I had skipped a chapter somewhere, lost a transition. Lost in transition. Maybe that's what I am.

But I don't want to wallow in the melodrama of it all. And so, the yoga class. I am determined to move into the future alongside my daughters, these near-women. I hope to cross soon to the side where the gain is as clear and perceptible as the feeling of loss.

Anti-abortioners get them while they're young

My daughters came home from a street fair near our home with this "cute rubber baby" -- given to them by an anti-abortion group that had set up a table at the fair. The trouble is, my daughters are 12 and 10. These activists apparently pulled them aside -- or maybe just lured them over with rubber babies and pencils -- and talked to them about abortion without their parents present.

My daughters came home from a street fair near our home with this "cute rubber baby" -- given to them by an anti-abortion group that had set up a table at the fair. The trouble is, my daughters are 12 and 10. These activists apparently pulled them aside -- or maybe just lured them over with rubber babies and pencils -- and talked to them about abortion without their parents present.

My girls came home and asked me what abortion is. The activists had told them something about "ripping up a baby" in the womb. I answered the question -- I believe in giving my kids good information when they're curious, along a healthy dose of spin about our family's beliefs. But I resented this group for introducing my kids to this issue too young and framing it with their bias.

It's not that we don't talk about sexuality and reproduction at home. Their dad and I have explained the facts of life and the dangers of becoming pregnant as a consequence of having sex. We've taken every opportunity to teach them to respect their bodies -- by eating well, by not lifting their shirts for second-grade boys on the school bus.

But what happened to my rights as a parent to teach them about life and morality at my own pace? These anti-abortion folks, as usual, seem to care more for the life of some hypothetical baby than for the innocence of the two young girls standing in front of them.

I've heard that some 10-year-olds can be very mature and even sexually active. But mine simply are not. They carried the rubber babies around for the rest of the weekend, talking about how cute they are, and made them a place to sleep in their dollhouse.

This rubber baby was supplied by heritagehouse76.org, an online warehouse supplying any number of items to the anti-abortion movement. The company was founded by Virginia and Ellis Evers, activists who began using silhouettes of tiny baby feet on lapel buttons in the 1970s to further their cause. The rubber babies must have come later. You can order them in several different models and three "ethnicities." (White baby shown above.) The people at the street fair also gave my daughters a pencil with a silhouette -- which is the size of a 10-week-old baby's feet.

Fortunately, the other side was represented at the fair too. My kids also came home with bright pink lapel pins stating, "My body is not public property." These came from the American Civil Liberties Union. My 10-year-old read the pin out loud to me, and I responded, "That's right. Your body is not public property." Especially not for some anti-abortion fanatic at a street fair trying to indoctrinate little girls before their time.

Lost in suburbia

I recently visited my dentist. As I was walking down the hall, the receptionist asked if I'd like a magazine and suggested I choose something from the left-hand side where "Ladies' Home Journal" and "Home and Garden" were displayed. The other tier contained magazines about "politics and business -- boring stuff," she assured me. I considered saying something quippy about how I have been writing about politics and business for 20 years and don't consider it at all boring. I used to speak up more when I was younger, just to shake up people's perceptions. I look like what I am: a 40-something suburban mom. But that doesn't mean mommy and political junkie can't exist in the same person.

My quips have not succeeded in educating the world, however, and some days I choose to stop trying. The tide keeps coming back in to wash away my sand castles.

Also, I realize that the receptionist was trying to be nice -- something I appreaciate more now than at a younger time. She wasn't trying to make me feel alienated and freakish, even if that was the result.

It's been about 18 months since I stopped commuting from suburban Long Island into Manhattan. I miss it. Now it's suburbia for both home and work. All suburban, all the time.

Anxious all the time

This economy is making me anxious all the time. It doesn't seem as though it should -- my husband and I are two of the lucky ones who have jobs, and our employers seem to be doing OK. No, it's not really my personal situation that has me anxious. It seems like something in the air. First of all, the sheer number of people laid off is astounding -- 663,000 people lost jobs in March alone, and 3.3 million since October. Those are U.S. Bureau of Labor Statistics numbers, so they're probably an under-count. The BLS tends to miss informal work arrangements, people who are discouraged and have stopped looking for work, those who would work more hours if they could, and people who used to have higher-paying jobs.

Every time I think of that number -- 663,000 -- I try to picture all of those people out of work. I really can't. First I come up with a vague image of a tractor rusting in a Midwestern field. Then I picture empty Long Island Rail Road seats as Wall Streeters stay home instead of commuting into NYC. And then I think of how hard it is to be home when you want to work, how much tension it creates.

The other cause of my anxiety is that I feel poorer because of what has happened to my retirement and college savings. We are still shoveling money into these funds, and I have no idea whether that's a foolish thing or not. One theory is that we are "buying low" right now. But is my 401(k) administrator really purchasing stocks? The last time I looked, much of the money had been shifted into bonds. Doesn't this mean that I have "locked in my losses?" I know that I should be more diligent, and maybe take over control of this account myself. But I really don't have any expertise in that. I just signed up to be a journalist in this life. Now, I'm supposed to be picking stocks? Or what? No retirement for me! It's overwhelming.

I can't even get into the college savings stuff. Each of my daughters' accounts has lost about $3,000. What happened to the "magic of compound interest" theory that I was raised on? It's not there any more! There is no more magic. I keep wondering how much debt I will be saddling my children with -- and here's the really crazy part. They are both still in grade school.

Like I said, this anxiety thing is insidious.

Working more: the legacy of layoffs

I apologize for being absent. The truth is that I am writing another blog, one that is work-related. And the reason is that the blogger before me was laid off. So, now I'm doing my old job plus hers. Those of us who remain at work after the "downsizing" often work much harder. I'm not working so many more hours -- maybe a few more -- so much as that my mental capacity is drained for anything outside of work. I spend several hours a day burning the battery on high wattage. And when I come home, there's very little left. I'm putting most of what's left toward making sure my kids are on track -- school papers signed, tests prepared for, etc. Seeing them happy gives me a lot of pleasure.

If the women of the 19th century and earlier were often too burdened with housework and field work to write, maybe we women of the 21st century are the same, only bound by a different sort of work. I had always dreamed of hours and energy enough to write something really good. Now I feel that this will happen only if/when I retire. And by then, I might not be up to it. Who knows?

I'm sorry to be self-pitying. These thoughts make me very sad.

Doubting the breadwinner

Today, I read this very honest essay from a woman whose live-in boyfriend has been laid off. He's pursuing his "big dreams" and living on his severance -- while she's wondering if he's ever going to bring in a paycheck again. She's trying not to be "ugly," while at the same time revisiting her hopes for a house and kids some day. The writer, Esther Martinez, concludes:

I hope our relationship makes it through this recession. I wonder how many won't. My boyfriend's layoff has stirred up scary notions about love - that it really might be conditional, and that the conditions are not always pretty.

My first reaction was admiration for Ms. Martinez for her courage in exposing her feelings like this. I remember being so ashamed about how much of my regard for my husband was tied to his bread-winning. Of course, we weren't just dreaming about kids when his joblessness started, we had a 3-year-old and an 18-month-old, as well as a mortgage. So, perhaps I can be forgiven for my anxiety over how we were going to hold this house of cards together. I was freelancing at the time, and shortly went back to full-time work. But my salary didn't come close to covering our expenses.

My second reaction to the Martinez essay was how hard it is to convey these fears to people who have not been through it. I will sometimes tell people that many "social ills" can arise because of a layoff. But that's a euphemistic mask I'm placing over what we went through. Ms. Martinez says it better. By social ills, I mean to hint at domestic violence, divorce, substance abuse, depression, suicide, crime. Those things seemed a lot more possible during the layoffs. A middle-class, Catholic, law-abider, I had never expected the wings of those problems to brush me.

I wasn't the only one who assumed my husband's status as a spouse was diminished, though. I told one man that Dan had just been laid off for a second time, and this man seemed to view it as a come-on, and as an invitation to move in and pursue me. I guess he thought that if my husband wasn't fulfilling his bread-winner duties that we would soon be divorced. Those assumptions run deep in American culture.